Making Insurance Payments in Advance Is an Example of:

O A prepaid expense transaction. For example progress paymentspartial payment for work thats been completed so farcan be.

Prepaid Insurance Definition Journal Entries Is It An Asset

Usually the rates that agents are paid are equal to something between 40 and 90 depending upon the company and product of the premium paid during the first year.

. Understanding Advance Payments Advance payments are amounts paid before a good or service is actually received. With advance billing invoices are sent to clients before the project has been completed. An accrued receivable transaction.

Look professional and stay organized. - 6217952 abiii23 abiii23 04112020 English Senior High School answered Making insurance payments in advance is an example of. Key Takeaways Prepayments are the payment of expenses or debt obligations ahead of the due date.

Most low-down mortgages require a down payment of between 3 - 5 of the property value. A prepaid cell phone is an example of an advance payment. A companys property insurance liability insurance business interruption insurance etc.

Is a tool to reduce your risks. An accrued revenue is the type of income that has been gotten or obtained although no cash payment has been made. Making insurance payments in advance is an example of.

The balance that is owed. O An accrued liability transaction. Accounting QA Library Making insurance payments in advance is an example of.

Accounting questions and answers. Under an advance payment bank guarantee the guarantor undertakes to repay an advanced payment that the principal has received in the event that the principal does not fulfill the terms of its contract. Advance payments can be a deposit partial payment or full lump sum.

1 See answer Advertisement Advertisement watashiwabakadesu watashiwabakadesu Answer. 10 making insurance payments in advance is an example. Accrued liabilities are expenses that have been incurred although the expenditures.

An adjusted trial balance. On the other hand a comprehensive deductible is reserved for. Although you would expense these payments when made they are subject to balance day adjustments under the accrual system.

A balance day adjustment is required when an entity has paid for goods and services like insurance in advance. Advance rent paid for the occupation of a space for carrying on a business activities. Examples of prepayment include loan repayment before the due date prepaid bills rent salary insurance premium credit card bill income tax sales tax line of credit etc.

Even if the owner of the contract is not making the payment in a lump sum for instance monthly or quarterly payments were chosen the life insurance company will sometimes. Payment for an asset that has yet to be gotten is called a prepaid expense. Ilacounts and their balances after updating account balances for.

An advance payment bank guarantee sample will be provided on this page. O A prepaid expense transaction. When the company makes an advance payment for insurance it can make prepaid insurance journal entry by debiting prepaid insurance account and crediting cash account.

Professional look and organization for small businesses. An accrued expense C. Definition of Payment for Insurance.

Advance payments also act as a tool to attain monetary benefits. 1Making insurance payments in advance is an example of. An advance payment bank guarantee is a type of bank guarantee.

Mortgage programs which require a minimal down payment. Insurance paid in advance is an example of a prepayment or often called a prepaid expense. A prepaid expense transaction.

Making insurance payments in advance is an example of. 10 Making insurance payments in advance is an example of. O A deferred revenue transaction.

Making insurance payments in advance is an example of. The one-year period for the insurance rarely coincides with the companys accounting year. Depending on the chosen program you can partially or completely protect yourself from unforeseen expenses.

Multiple Choice O An accrued expense transaction. О O An accrued liability transaction. An unearned revenue transaction.

An accrued expense transaction. 7A list of all accounts to as. Making insurance payments in advance is an example of an.

D A prepaid expense. O A deferred revenue transaction. Payments made for the insurance of a business asset in order to minimise the loss in case of any mishap.

A deferred revenue transaction. 11 Recording revenue that is earned but not yet collected is an example of. This is due to one asset increases 1200 and.

2 Medium Learning Objective. Therefore the insurance payments will likely involve more than one annual. However some lenders have.

A deferred expense transaction. 03-03 Demonstrate the purposes and recording of adjusting entries. In this case the company ABC can record the prepaid insurance of 6000 on December 18 2020 with the journal entry below.

Making insurance payments in advance is an example of. Such payments are made in advance and upon the payment it is recorded as an asset the examples of such payments are listed as under. An accrued revenue transaction.

There are two types of deductibles when it comes to car or auto insurance. Start for free today. O An accrued receivable transaction.

Likewise the net effect of the prepaid insurance journal entry in this example is zero on the balance sheet. A prepaid expense transaction. Ad Create a custom advance payment invoice in minutes.

An advance payment is a type of payment that is made before a service has been rendered. An accrued liability transaction. The first type is a collision deductible which is for covering the cost of repairs to a vehicle in case of a collision unless you are deemed at fault for the accident.

For example on December 18 2020 the company ABC make an advance payment of 6000 for the fire insurance that it purchase to cover the whole year of 2021. Making insurance payments in advance is an example of a prepaid expense. Often covers a one-year period with the cost insurance premiums paid in advance.

A trial of a balance. And if the accident insurance event occurs the insurance company will bear all or all of the costs in full or in part.

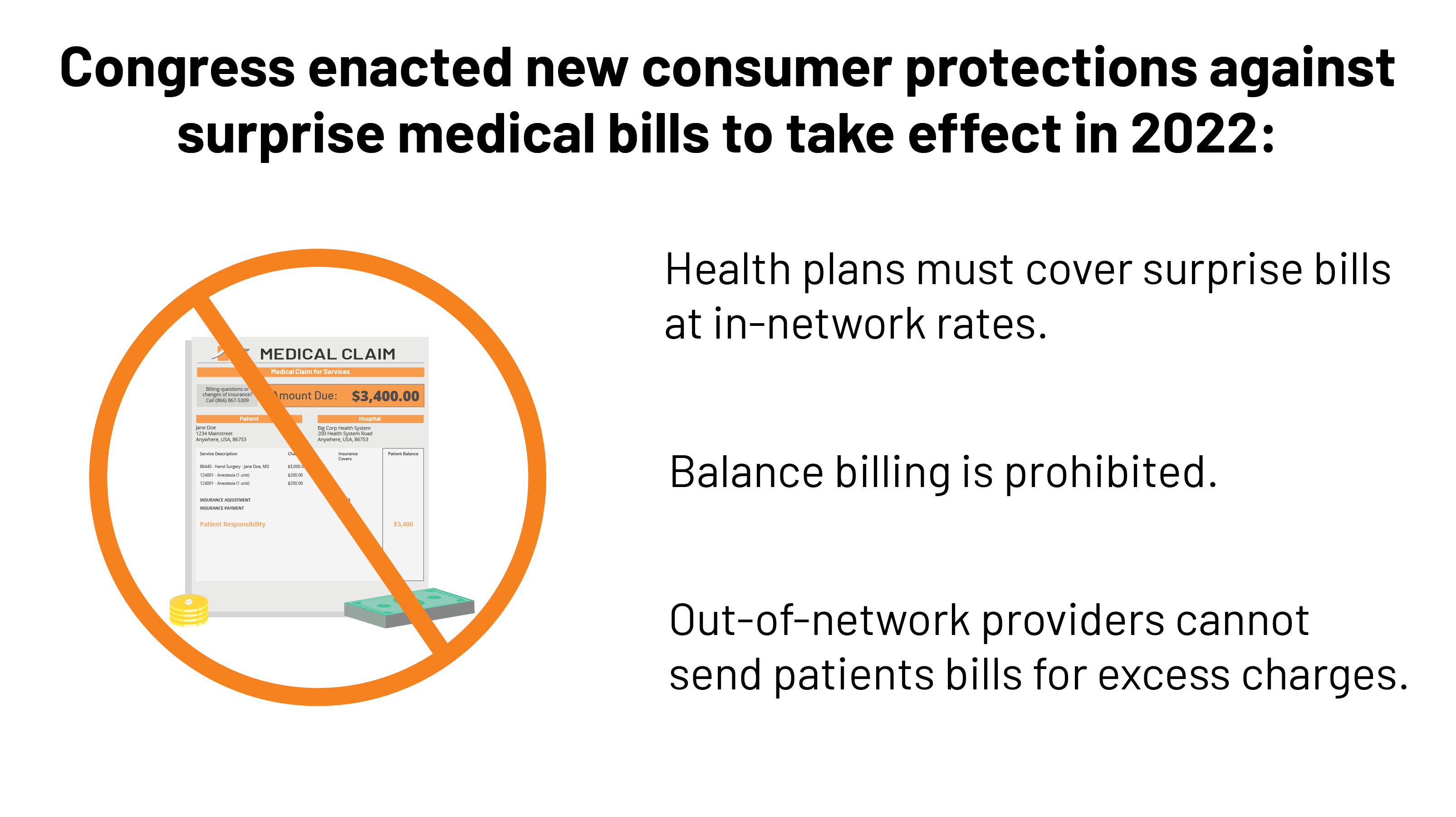

Surprise Medical Bills New Protections For Consumers Take Effect In 2022 Kff

Adjusting Entries For Asset Accounts Accountingcoach

5 Types Of Private Mortgage Insurance Pmi

Sale Page Template Example Want To Work Less While Earning More Than Ever Before Business Letter Sample Sales Letter Templates

How Is Homeowners Insurance Paid Progressive

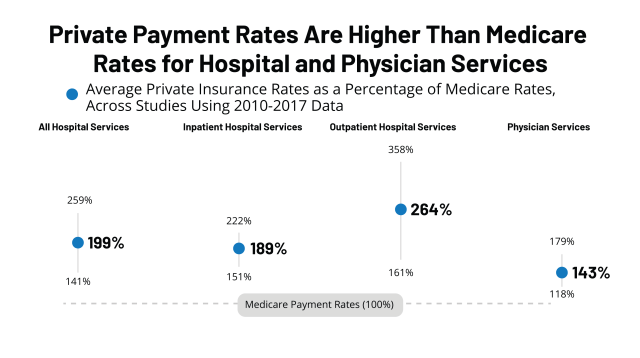

How Much More Than Medicare Do Private Insurers Pay A Review Of The Literature Kff

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-02-21e195b2934c40518828dc904cbdb86f.jpg)

How Are Prepaid Expenses Recorded On The Income Statement

Self Employed Health Insurance Deduction Healthinsurance Org

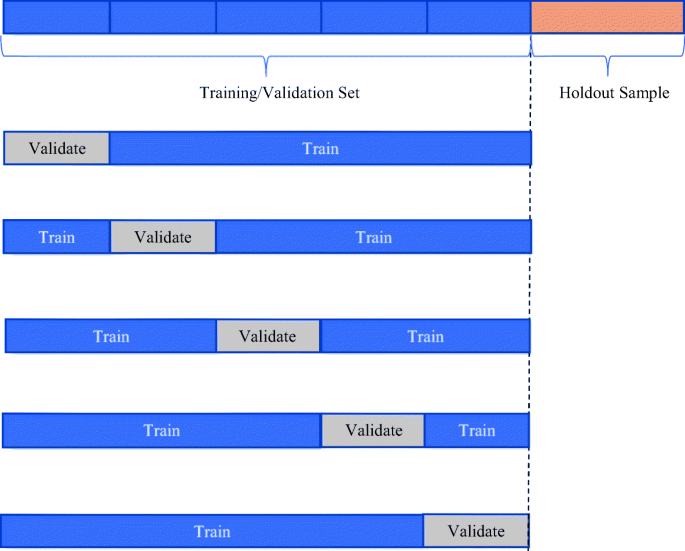

Machine Learning Improves Accounting Estimates Evidence From Insurance Payments Springerlink

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)

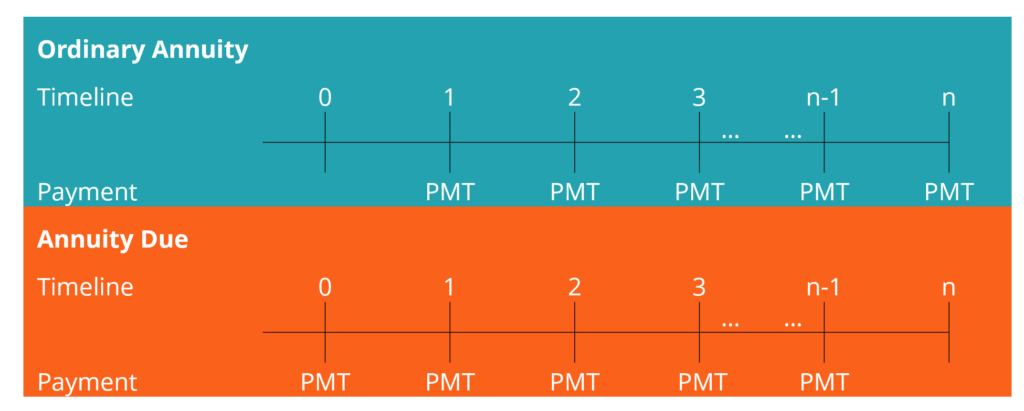

Calculating Present And Future Value Of Annuities

Annuity Due Overview Present And Future Values

Expat Health Insurance In The Netherlands Zorgwijzer

Insurance Definitions Features

178 Reference Of Auto Insurance Policy Example Be An Example Quotes Insurance Policy Progressive Insurance

What Are The Benefits Of Financial Planning Debt Management Financial Planning All About Insurance

Insurance Journal Entry For Different Types Of Insurance